The History of Life Insurance: Who, What, Where, When & How

Unlike other bedrock institutions such as banking and the stock market, life insurance has always been an unflinchingly secure option to ensure financial security.

The flexibility term insurance provides young families, along with its generous payouts bought at affordable rates, make the unthinkable a bit less scary.

With their assets protected, term life policyholders can later convert their term policies to more lucrative dividend-producing ones and enjoy the even stronger financial benefits wealthy families have enjoyed for centuries.

How It All Started

Social responsibility is at the heart of what life insurance is all about.

A lot of historians say the concept of life insurance started in Ancient Rome around 600 BC. At the time, the Roman Empire’s burial rites were an expensive undertaking that included music, processions, intricate urns, and body preparation.

They believed that if someone wasn’t buried properly, the dead would come back to haunt them.

Many people couldn’t afford all this pomp, especially military members whose numbers fell on a regular basis. To remedy the situation, military leader Caius Marius ordered his soldiers to contribute to a fund to cover each fallen soldier’s burial costs.

Soon, everybody in the community was taking advantage of this early form of life insurance. Members contributed a copper or two into a “casket kitty” that enabled everyone to bury their dead with dignity.

So it seems the concept of life insurance started about 2,000 years ago.

The First Official Life Insurance Policy

On June 18, 1583, a Londoner named Richard Martin paid thirteen merchants thirty pounds each to finance a 400-pound payout should a man named William Gybbons die within the next year. No one seems to know why. But when Gybbons did die within 12 months, the merchants squabbled about what constituted a lunar year. Martin didn’t get the payout.

And guilds in the Middle Ages successfully shared life insurance policies that protected people working in dangerous trades like building and blacksmithing from financial loss due to accidental death and dismemberment.

The First Official Life Insurance Company

Two guys named William Talbot and Sir Thomas Allen got together in 1706 and created The Amicable Society for Perpetual Assurance Office, and most people agree that it’s the first known life insurance company.

How it worked: Each member between the ages of 12 and 55 made an annual payment for one to three shares. These “amicable contributions” were divided among the families of deceased members at the end of each year. An estimated 2,000 people joined the society.

Other life insurance enterprises started springing up. Shipping workers formed an association to protect their families, and venture capitalists financing trips to the New World took out insurance on their crews. Meetings among the groups took place at Lloyd’s Coffee House, which later became Lloyd’s of London.

More business led to unscrupulous misdeeds. So, in 1774, Great Britain passed the Life Assurance Act to protect the public from insurance agent corruption.

The First Official Actuary Tables

Although historians tell the story differently, the basic idea is that a couple of people are responsible for creating the actuary tables using mortality rates to determine premiums.

It started when actuaries started reviewing church records to determine average life spans. Not long after, a guy named James Dodson produced a formula using these rates to determine how much a policy was worth. In 1762, Edward Rowe Mores used these formulas in the Equitable Life Assurance Society he formed to sell policies.

History of Life Insurance in the U.S.

Life Insurance crossed over to the U.S. in the eighteenth century through the Presbyterian Synods in Philadelphia and NYC. The enterprise started out as a fire insurance company in 1735 but grew into the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759.

Interesting fact: Within the next century preachers would demonize life insurance—calling it gambling.

Later, the 1837 financial crisis ushered in a push toward owned share business structure. Life insurance companies began offering mutuals instead of raising their capital through stocks alone. This opened the way for big-name companies like New York Life, John Hancock, MassMutual, and MetLife to start business, and as we all know, they’re still in business today.

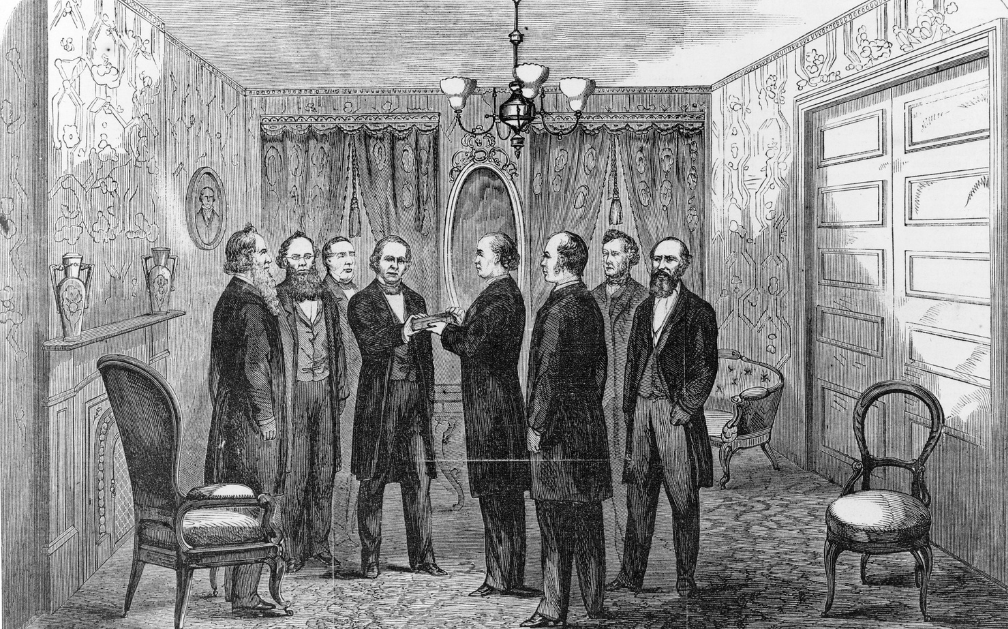

But it wasn’t long before insurer fraud necessitated state regulations to tamp it down. At the 1871 National Insurance Convention, a National Association of Insurance Commissioners was formed to protect policyholders. It continues to oversee the industry today.

A few years later, Prudential began protecting working-class families in Newark, New Jersey, through the Widows and Orphans Society, which allowed women to collect on a husband’s life insurance policy for the first time.

And while World War I was going on across the Atlantic, the life insurance industry thrived. Beginning in 1917, insurance companies sold 120 million policies over the next two decades. And then, following a fallow period during the Depression, life insurance purchases surged again post-World War II.

By the mid-1970s, more than 90% of married couples owned a policy. And today’s technology makes online buying possible and even easier to purchase.